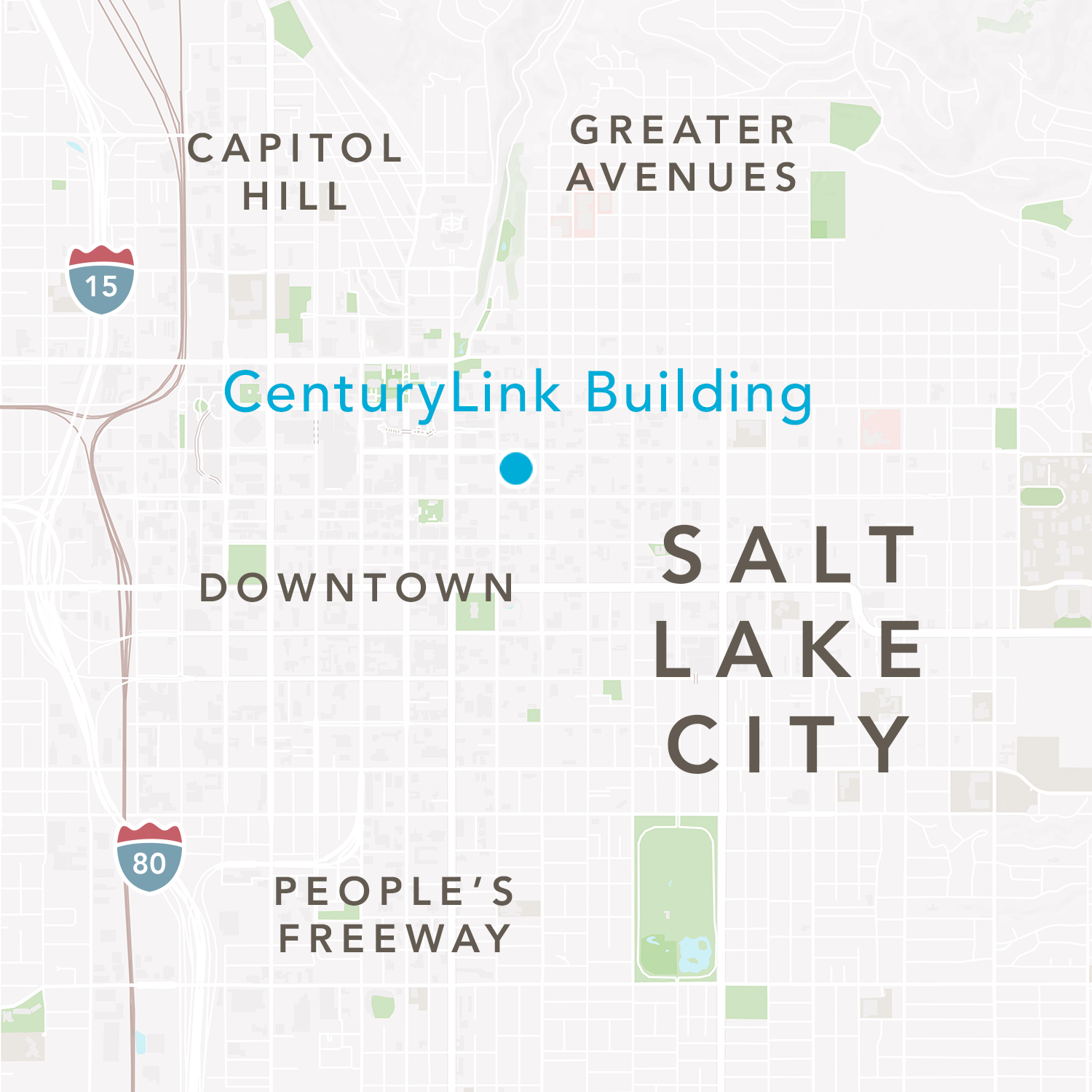

Unico had identified Salt Lake City as an undervalued market in the prior investment cycle, yet well located acquisition opportunities remained scarce. We were particularly interested in participating in the tailwinds offered by recent investments made in transit, retail, and residential that were creating an urbanization trend clearly playing out elsewhere in the country. The challenges we met in this complex user-sale included working through terms for the seller’s leaseback of about 40% of the tower building; synthesizing incomplete and sometimes inaccurate information provided by a non-investor seller; de-risking the lease-up and solving an under-parked ratio; and identifying multiple execution paths for the soon-to-be-vacated data center property.